Disinfectant and Deodorant Market Growth CAGR Overview

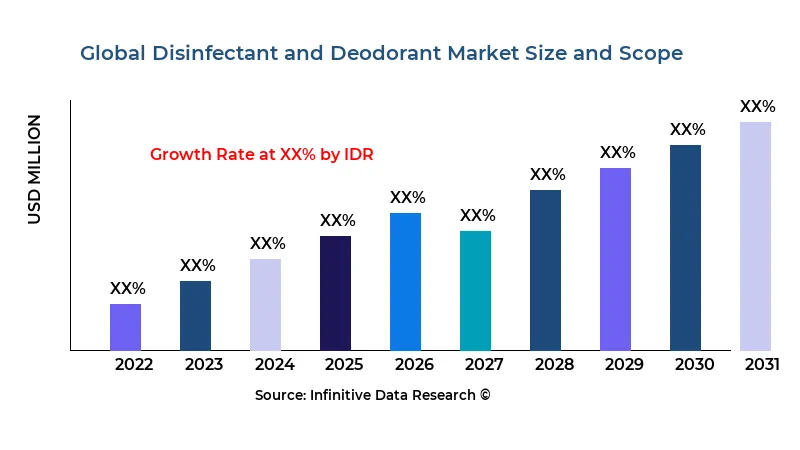

According to research by Infinitive Data Research, the global Disinfectant and Deodorant Market size was valued at USD 6.7 Bln (billion) in 2024 and is Calculated to reach USD 9.8 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 6.8% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Consumer Goods industries such as Medical, Commercial, Household, Industrial, OtherThe global disinfectant and deodorant market is experiencing heightened demand as consumers and industries alike seek dual-function products that both eliminate pathogens and neutralize odors in a single step. These hybrid formulations combine bactericidal or virucidal active ingredients such as quaternary ammonium compounds, hydrogen peroxide or isopropanol with odor-blocking polymers or fragrances designed to mask or chemically neutralize malodors. End users range from healthcare and hospitality to automotive and public transportation, where restroom and cabin sanitation workflows rely on multipurpose solutions to streamline inventories and reduce labor time. Regulatory agencies now require validated efficacy claims for both disinfection and deodorization, prompting R&D teams to develop standardized test protocols that ensure products meet EN 1276 or ASTM E1153 standards while delivering odor-control performance.

Innovations in encapsulated fragrance microcapsules and slow-release deodorizing matrices have extended residual odor-masking activity for up to 72 hours, further differentiating premium product tiers. Manufacturers introduce concentrated, trigger-spray and aerosol formats to cater to a spectrum of application needs, from handheld pet-care sprays to industrial-scale fogging systems deployed in food-processing plants. As a result, the market has seen consolidation around a few key players with broad formulation portfolios and global regulatory expertise, while agile niche brands leverage local odor-problem specialization to capture regional opportunities. Historically, disinfectants and deodorants were sourced separately, creating added complexity for facility managers, whereas hybrid products enable single-step protocols that reduce contact time and chemical handling risks.

Many commercial cleaning routes now prescribe sequential application of deodorant sprays following disinfection, but integrated solutions offer the promise of matched chemistries that avoid antagonistic reactions that could reduce microbial kill rates. The increased prevalence of enclosed public spaces—ride-sharing vehicles, shared-economy dwellings and micro-hospitals—has elevated expectations for ambient air quality alongside surface hygiene, driving development of aerosolized disinfectants that deposit odor-neutralizing catalysts on porous surfaces. Simultaneously, consumer preferences for “clean scent” and eco-friendly ingredients have spurred demand for bio-based or naturally derived deodorizing agents such as cyclodextrins and essential-oil emulsions, forcing formulators to validate their compatibility with registered disinfectant actives.

Quality- and performance-claims verification through third-party labs adds both cost and time to product development cycles, pushing larger incumbents to build in-house testing facilities to accelerate time-to-market. Meanwhile, intensifying scrutiny on VOC emissions and fragrance allergens in the EU has led to the reformulation of existing products to comply with REACH and IFRA guidelines, while U.S. regulators monitor fragrance-ingredient disclosures under California’s Safer Consumer Products program. This complex regulatory matrix has created regional product variations, requiring multinational brands to manage distinct formulations for North America, Europe, Asia-Pacific and Middle East markets. The interplay between microbial efficacy and odor performance remains the principal challenge for R&D, as consumers demand both instantaneous kill and a long-lasting fresh-smell experience.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Disinfectant And Deodorant Market Growth Factors

Consumer and institutional emphasis on continuous hygiene monitoring, intensified by global pandemics, is propelling demand for combined disinfectant and deodorant products that reduce the labor burden of separate applications. Facility managers and homeowners alike value single-step solutions that promise both microbicidal action and long-lasting scent, as they streamline workflow and enhance user perception of cleanliness. The cost advantage of purchasing one hybrid product versus two standalone formats drives procurement decisions, especially for volume buyers in sectors such as hospitality and healthcare. Growing acceptance of no-rinse deodorizing disinfectants simplifies post-clean protocols, reducing water usage and accelerating turnover times in high-traffic areas like restrooms and locker rooms. As IoT-enabled janitorial robots gain traction, formulators are optimizing hybrid chemistries to be compatible with robotic dispensing mechanisms and sensor-based dosing algorithms. This integration of hardware and chemistry ensures precise application volumes, minimizes overuse and contributes to sustainability goals through waste reduction. Increasing focus on indoor air quality by building-occupancy sensors and LEED certification standards enhances the appeal of aerosolized disinfectant-and-deodorant formulations that simultaneously neutralize pathogens and VOCs. Hybrid products also support green-building initiatives by reducing the need for multiple chemicals and lowering overall environmental impact.

The expansion of telemedicine clinics and pop-up vaccination centers has created ad-hoc sanitation requirements where portable disinfectant-and-deodorant sprays offer rapid deployment and minimal infrastructure needs. Event-venue operators and mobile retailers now stock compact, scented disinfectant solutions to maintain brand-consistent atmospheres while safeguarding public health at festivals and outdoor gatherings. Fiscal incentives and tax credits for small businesses investing in enhanced safety measures accelerate hybrid product adoption in restaurants, gyms and barbershops seeking to reassure customers. Partnerships between fragrance houses and active-ingredient formulators have produced novel scent profiles that mask harsh chemical odors, improving end-user acceptance and facilitating repeated application. Consumer appetite for natural or plant-based deodorizing extracts—like citrus terpenes, peppermint oil and activated charcoal—drives R&D toward formulations that marry green fragrance chemistry with proven disinfectant efficacy. Pilot programs in corporate offices use scent analytics to measure occupant satisfaction, influencing decisions to standardize on specific hybrid disinfectant-and-deodorant products. Such sensory-driven procurement decisions underscore the importance of product aesthetics alongside performance in a competitive marketplace.

The proliferation of subscription-based refill models for disinfectant-and-deodorant cartridges fosters higher repurchase rates and stable revenue streams for manufacturers. These direct-to-consumer offerings also provide data insights into usage patterns, enabling smarter inventory planning and the tailoring of fragrance portfolios to seasonal preferences. Digital marketplaces are emerging where facilities can compare hybrid product ratings on kill-spectrum and scent longevity, creating transparency that favors scientifically validated brands. Social-media campaigns demonstrating ease of use—spray, wipe, breathe—have elevated consumer awareness and positioned hybrid formulations as a convenience must-have. Retailers are responding by dedicating shelf space to hybrid disinfectant-and-deodorant categories, often bundling them with specialty cleaning accessories to drive impulse purchases. As a result, manufacturers are extending their SKUs to cover travel-friendly sprays, bulk dispensers and electrostatic-nozzle cartridges to meet diverse end-use scenarios. This SKU proliferation both deepens market penetration and raises the bar for supply-chain complexity and demand-forecasting accuracy.

Emerging economies in Asia-Pacific and Latin America are adopting hybrid disinfectant-and-deodorant solutions in public transportation and hospitality segments to uphold evolving sanitation norms. Local regulatory endorsements, such as expedited EPA registrations or provisional marketing codes, accelerate time-to-market for new hybrid formulas in target geographies. Cross-sector collaborations between pharmaceutical and fragrance companies are unlocking novel antimicrobial botanicals with inherent deodorizing properties, reducing reliance on synthetic actives. Collaborative open-innovation labs funded by major custodial-product vendors attract academic and startup talent to co-develop next-generation hybrid technologies. Investment in biodegradable surfactants and low-FOG carriers ensures that hybrid products can be deployed in food-prep zones without cross-contamination risks. Moreover, smart-packaging initiatives incorporate RFID tags that validate dispenser refill authenticity, preventing adulteration and reinforcing brand trust. Funding from ESG-focused investors is channeling into companies that can demonstrate closed-loop production, recyclable cartridges and carbon-neutral formulations. Ultimately, the hybrid disinfectant-and-deodorant market’s rapid evolution is powered by the convergence of sustainability, digitalization and sensory-led differentiation.

Market Analysis By Competitors

- Unilever

- Reckitt Benckiser

- P&G Professional

- Clorox

- Ecolab

- Orapi Hygiene

- Kimberly-Clark

- 3M

- S.C. Johnson & Son

- Sanytol

- Amity International

- Alkapharm

- Orochemie GmbH

- Steris Corporation

- Zep Inc.

- Diversey

- Sanosil

- ACTO GmbH

- Spartan Chemical

- Oxy'Pharm

- Buckeye International

- QuestSpecialty Corporation

- Kemika Group

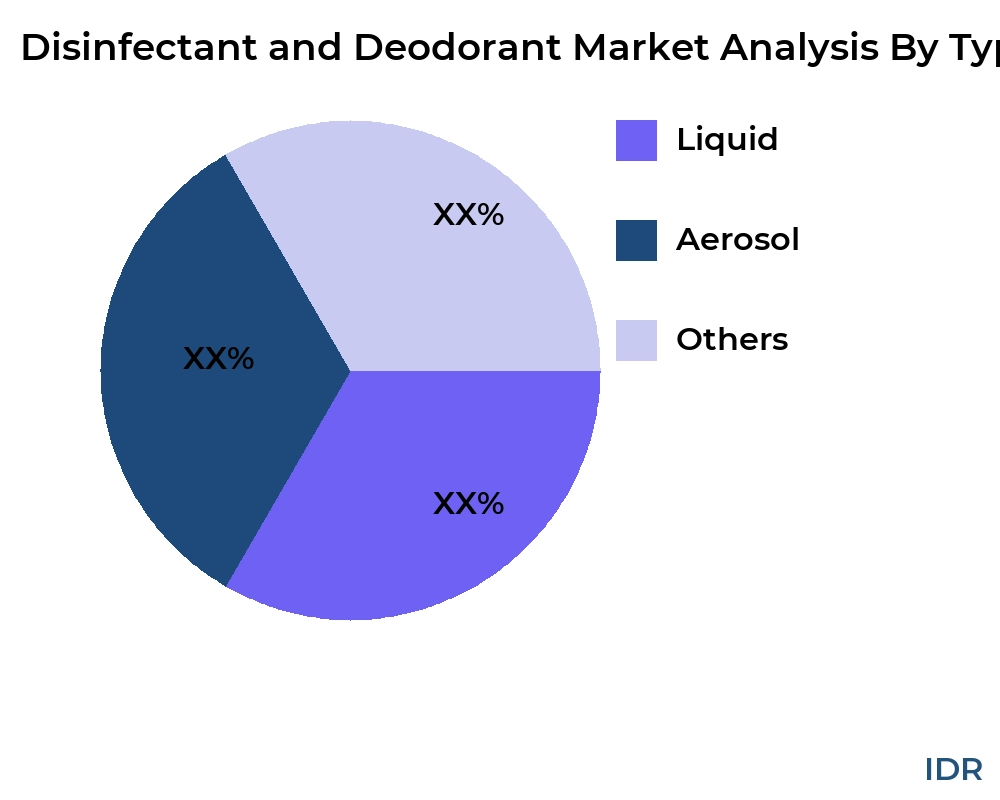

By Product Type

- Liquid

- Aerosol

- Others

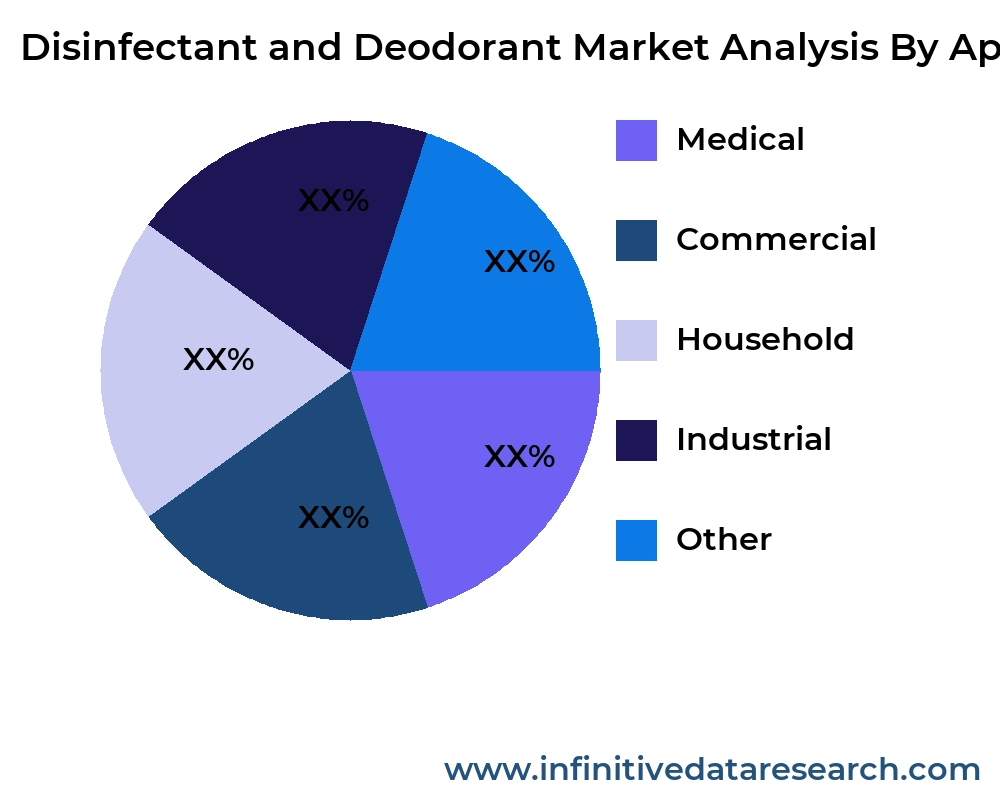

By Application

- Medical

- Commercial

- Household

- Industrial

- Other

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Disinfectant And Deodorant Market Segment Analysis

Distribution Channel

Disinfectant and deodorant products reach end users through direct OEM sales for large-scale facility contracts, specialized janitorial distributors that bundle equipment with chemicals, and retail channels ranging from home-improvement superstores to online marketplaces. OEM and janitorial distributors provide design-in support, on-site training and just-in-time inventory to high-volume buyers in healthcare and hospitality. Retailers and e-commerce platforms focus on convenience packaging—travel sprays and subscription refill kits—targeting consumers seeking home-use solutions. Cross-channel promotional partnerships with fragrance and cleaning-equipment brands further amplify visibility and drive incremental sales.

Compatibility

Formulation compatibility hinges on active-ingredient interactions, pH stability and material-contact considerations. Hybrid disinfectant-and-deodorant chemistries must be formulated to avoid polymer or metal surface damage, comply with FDA-grade elastomer compatibility for medical devices, and maintain activity in the presence of organic load. Manufacturers offer differentiated grades certified for use on stainless steel, plastics, ceramics and textiles, ensuring products perform reliably across diverse substrate types. Compatibility with automated dispensers—pump, foam or aerosolized—dictates surfactant and propellant selections, requiring rigorous shelf-life and dispense-performance testing under varied temperature and humidity conditions.

Price Range

Economy trigger-spray hybrids suitable for household or small-office use are priced under USD 5 per 500 mL, leveraging simpler fragrance and active-ingredient systems. Mid-tier formulations—including multi-surface aerosols and bulk concentrates for commercial cleaning—range USD 10–25 per liter. Premium contract-manufactured cartridges for automated dispensers, featuring encapsulated fragrances and specialty actives, command over USD 50 per liter, justified by enhanced residual activity, lower VOC content and custom scent profiles. Volume-discount programs and subscription models moderate per-unit costs for large institutional buyers.

Product Type

Core product typologies include trigger-spray concentrates, ready-to-use aerosols, foaming dispensers and bulk dilutable chemistries for central dosing systems. Trigger sprays offer portability and targeted application, while aerosols provide even coverage and extended residual release. Foaming systems optimize contact time and minimize over-spray in restroom fixtures. Bulk concentrates cater to high-throughput cleaning operations, integrating seamlessly with automated dosing in chemical feed skids. Each format addresses distinct workflow efficiencies and ergonomic preferences.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Unilever, Reckitt Benckiser, P&G Professional, Clorox, Ecolab, Orapi Hygiene, Kimberly-Clark, 3M, S.C. Johnson & Son, Sanytol, Amity International, Alkapharm, Orochemie GmbH, Steris Corporation, Zep Inc., Diversey, Sanosil, ACTO GmbH, Spartan Chemical, Oxy'Pharm, Buckeye International, QuestSpecialty Corporation, Kemika Group |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Disinfectant And Deodorant Market Regional Analysis

North America leads the disinfectant-and-deodorant hybrid market, driven by stringent occupational-safety regulations and the resurgence of dining-out and travel segments. Facility managers across the U.S. and Canada demand validated, dual-action products to comply with OSHA, CDC and provincial health-department guidance for high-risk touchpoints. Major cleanup-service providers and national custodial chains have standardized hybrid chemistries to simplify training and reduce chemical-handling incidents. Tech-savvy hospitality operators in Las Vegas and Miami deploy scented disinfectant robots to deliver consistent hygiene experiences in casinos and hotels.

In Europe, Germany, France and the U.K. have seen rapid uptake of low-odor, biodegradable hybrid formulations aligned with EU-Ecolabel and BPR (Biocidal Products Regulation) requirements. Fragrance-sensitive markets like Scandinavia favor mild, hypoallergenic deodorizing agents paired with rapid-kill disinfectants. Hospitality and transportation hubs in London and Paris pilot next-gen hybrid products that incorporate photocatalytic oxidation additives to neutralize residual VOCs under ambient light. Regulatory complexities—such as the UK’s GB-BPR post-Brexit regime—drive regional product differentiation among leading multinationals.

Asia-Pacific is the fastest-growing region, with China’s domestic cleaning-product giants and India’s contract-packers racing to introduce homegrown hybrid disinfectant-and-deodorant lines. Urban-mass transit operators in Tokyo and Seoul specify hybrid fogging systems for nightly train and subway sanitation, combining odor-control profiles designed to mask engine and brake dust fumes. Southeast Asia’s hospitality sector—particularly in Singapore and Thailand—requires hybrid sprays that meet both fire-code approvals and tropical-climate stability standards. Wholesalers in Jakarta and Manila bundle hybrid products with micro-fiber cloths and smart dispenser refills to accelerate adoption in small-and-mid-sized enterprises.

Latin America and the Middle East & Africa remain emerging markets characterized by patchwork regulations and diverse performance expectations. In Brazil and Mexico, hotel chains emphasize signature scents in hybrid disinfectant sprays to reinforce brand ambiance, while complying with ANVISA’s biocide registration timelines. Gulf Cooperation Council states insist on low-VOC aerosols for use in enclosed prayer and meeting rooms. Regional distributors partner with local fragrance houses to tailor deodorant notes, navigating customs-related fragrance-ingredient restrictions. Despite logistical challenges, demand for combined products continues to rise in municipal buildings and private-sector offices.

global Disinfectant and Deodorant market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Unilever | XX | XX | XX | XX | XX | XX |

| Reckitt Benckiser | XX | XX | XX | XX | XX | XX |

| P&G Professional | XX | XX | XX | XX | XX | XX |

| Clorox | XX | XX | XX | XX | XX | XX |

| Ecolab | XX | XX | XX | XX | XX | XX |

| Orapi Hygiene | XX | XX | XX | XX | XX | XX |

| Kimberly-Clark | XX | XX | XX | XX | XX | XX |

| 3M | XX | XX | XX | XX | XX | XX |

| S.C. Johnson & Son | XX | XX | XX | XX | XX | XX |

| Sanytol | XX | XX | XX | XX | XX | XX |

| Amity International | XX | XX | XX | XX | XX | XX |

| Alkapharm | XX | XX | XX | XX | XX | XX |

| Orochemie GmbH | XX | XX | XX | XX | XX | XX |

| Steris Corporation | XX | XX | XX | XX | XX | XX |

| Zep Inc. | XX | XX | XX | XX | XX | XX |

| Diversey | XX | XX | XX | XX | XX | XX |

| Sanosil | XX | XX | XX | XX | XX | XX |

| ACTO GmbH | XX | XX | XX | XX | XX | XX |

| Spartan Chemical | XX | XX | XX | XX | XX | XX |

| Oxy'Pharm | XX | XX | XX | XX | XX | XX |

| Buckeye International | XX | XX | XX | XX | XX | XX |

| QuestSpecialty Corporation | XX | XX | XX | XX | XX | XX |

| Kemika Group | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Disinfectant and Deodorant market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Liquid

XX

XX

XX

XX

XX

Aerosol

XX

XX

XX

XX

XX

Others

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Liquid | XX | XX | XX | XX | XX |

| Aerosol | XX | XX | XX | XX | XX |

| Others | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Disinfectant and Deodorant market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Medical

XX

XX

XX

XX

XX

Commercial

XX

XX

XX

XX

XX

Household

XX

XX

XX

XX

XX

Industrial

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Medical | XX | XX | XX | XX | XX |

| Commercial | XX | XX | XX | XX | XX |

| Household | XX | XX | XX | XX | XX |

| Industrial | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Disinfectant And Deodorant Market Competitive Insights

Large global chemical conglomerates dominate the hybrid disinfectant-and-deodorant market through vertically integrated models that span active-ingredient production, fragrance R&D and contract-manufacturing services. Their scale supports multi-regional manufacturing hubs and ensures prioritized raw-material allocations during supply-chain disruptions. These major players invest heavily in proprietary encapsulation technologies and maintain extensive in-house testing labs to meet diverse regional regulatory standards. Their broad portfolios allow seamless cross-selling into adjacent categories—hand sanitizers, air purifiers and surface treatments—deepening customer relationships and raising switching costs.

Mid-tier specialists differentiate through rapid custom-formulation services and niche odor-problem expertise, such as industrial-food-plant or healthcare-ward applications. They often operate agile pilot-plant facilities that can scale from lab batches to commercial volumes within weeks, appealing to contract packers and private-label brands. Their lean structures facilitate partnerships with fragrance-house start-ups, combining novel scent systems with proven biocide platforms. This speed-to-market advantage is crucial in responding to emerging disinfection challenges—new pathogens or odor nuisances.

Strategic acquisitions have accelerated portfolio expansion, as large incumbents tuck in innovative niche firms to fill performance or regional gaps. These bolt-on deals grant immediate access to novel delivery technologies—micro-foggers, electrostatic sprayers—and proprietary odor-neutralization chemistries such as melanocyte inhibitors. Post-acquisition integration challenges include harmonizing R&D roadmaps, aligning quality systems and preserving brand equity among acquired specialty labels.

Pricing pressures at the mid-tier and economy segments are intensifying, driven by private-label penetration in retail channels and bulk-supply agreements in institutional markets. Many buyers now demand “all-in” bids that include equipment, service and hybrid chemistries, forcing suppliers to offer bundled-pricing models and performance guarantees. Those unable to provide turnkey solutions risk margin erosion and contract attrition. Conversely, suppliers that excel at managed-services contracts—with remote monitoring, automatic replenishment and digital compliance reporting—gain stickiness and premium pricing power.

Disinfectant And Deodorant Market Competitors

Market Top Competitive Companies by Country

-

United States

-

Reckitt Benckiser

-

Clorox

-

Procter & Gamble

-

SC Johnson

-

Ecolab

-

-

Germany

-

Henkel

-

Beiersdorf (Elgydium)

-

Werner & Mertz

-

Dr. August Wolff

-

GEA Group (hygiene solutions)

-

-

China

-

Liby Group

-

Blue Moon Group

-

Nice Group

-

Yunnan Baiyao Group

-

Harbin Pharmaceutical (cleaning segment)

-

-

Japan

-

Kao Corporation

-

Lion Corporation

-

Shiseido (Deodorant division)

-

Kyowa Hakko Bio (antimicrobial CAPB)

-

Asahi Kasei (hygiene materials)

-

-

India

-

Godrej Consumer Products

-

Dabur India

-

Jyothy Labs

-

TTK Prestige (Cleanpro)

-

Patanjali Ayurved (natural deodorants)

-

-

Brazil

-

Unilever Brasil

-

Natura &Co

-

Bombril

-

OMO (Unilever)

-

Ypê

-

Disinfectant And Deodorant Market Top Competitors

Market Top 10 Competitors

-

Reckitt Benckiser

Reckitt leads with its Lysol and Finish brands, offering combined disinfectant-and-deodorant aerosols and trigger sprays. Its global R&D network enables rapid adaptation of formulations to meet regional biocide regulations. The company’s direct-to-consumer digital channels accelerate new-product launches and gather real-time usage data. Its private-label manufacturing arm reinforces scale advantages. Ongoing investments in green-chemistry initiatives aim to reduce VOC content and plastic waste. -

Clorox

Clorox’s portfolio spans Clorox Disinfecting Wipes and Clorox Clean-Up Cleaner + Bleach—each delivering proven microbial kill followed by odor-neutralizing fragrance. Its broad North American distribution network ensures deep retail penetration. Clorox’s QA labs in Oakland and Windsor validate dual-function claims under EPA guidelines. The company’s loyalty programs drive repurchase rates among both household and professional cleaning segments. Clorox continues to expand into aerosol-fogging products for professional sanitation. -

Procter & Gamble

P&G markets Febreze Antibacterial Trigger and Dawn Omega Dishwash Cleaner + Deodorizer under key brands, leveraging its consumer-research capabilities to refine scent profiles for target demographics. P&G’s scale affords locked-in supply contracts for key disinfectant actives, ensuring stability in volatile markets. Its “Subscribe & Save” e-commerce model fosters repeat purchasing. P&G’s packaging innovations include refill pouches that reduce plastic usage by up to 75 %. -

SC Johnson

SC Johnson’s Scrubbing Bubbles and Glade CleanLine dual-action formulations combine foam disinfectants with continuous-release deodorant beads. The family-owned company invests heavily in proprietary spray-nozzle technology to optimize droplet size and coverage. Its global supply chain supports co-manufacturing partnerships in Asia-Pacific and Latin America. SC Johnson’s open-innovation platform invites startups to co-develop natural-based odour eliminators. The firm’s corporate-social-responsibility programs focus on plastic circularity and PFAS-free formulations. -

Ecolab

Ecolab specializes in industrial disinfectant-and-deodorant systems for foodservice and hospitality clients, offering closed-circuit dosing modules and scent profiling services. Its on-site service teams conduct hygiene audits and supply bespoke fragrance blends for hotel chains and cruise operators. Ecolab’s 24/7 customer-support infrastructure ensures rapid response to contamination events. Its digital platform tracks chemical use and odor metrics across multi-site clients. Ecolab continues to innovate in antimicrobial polymer coatings that reduce odor adherence. -

Henkel

Henkel’s Loctite and Betadine lines incorporate disinfectant-and-deodorant chemistries for wound care and industrial-equipment sanitization. The company’s European footprint supports rapid compliance with BPR and REACH. Henkel’s cross-functional teams integrate fragrance-house expertise with its polymer and surfactant divisions. The firm’s private-label contract-manufacturing services cater to regional cleaning brands across EMEA. Ongoing research explores enzyme-based deodorization coupled with biocidal hydrogels. -

Liby Group

As China’s leading household-care producer, Liby offers dual-action sprays under the “Liby Sanitizer + Fresh” brand. Its domestic scale and state-backed safety approvals accelerate the rollout of new products in urban and rural markets alike. Liby’s distribution partnerships with Meituan and JD.com drive daily-deal promotions and subscription bundles. The company is piloting concentrated refill solutions to address plastic-waste concerns. Collaborative R&D programs with Tsinghua University explore nano-silver-infused deodorizing complexes. -

Kao Corporation

Japan’s Kao markets Blendy Café Style Cleaner + Deodorant for coffee-service equipment, combining surfactants with antimicrobial enzymes to tackle both biofilm and lingering coffee aromas. Its global headquarters in Tokyo oversees regional labs in Singapore and São Paulo. Kao’s global “Green Science” initiative targets biodegradable actives and reduced packaging. The company’s B2B division customizes hybrid products for spa, hospitality and healthcare clients. -

Godrej Consumer Products

Godrej’s Ecosmart and Aer Private Label sprays blend benzalkonium chloride with natural deodorizing extracts, addressing both microbial control and fragrance preferences in Indian households. The company’s agrifood vertical sources coconut-based surfactants for sustainable formulations. Godrej’s expansive dealer network ensures reach into tier-II and tier-III Indian cities. The firm’s “Fragrance Studio” in Mumbai co-develops custom scent profiles with regional artisans. -

Natura &Co

Brazilian Natura offers hybrid sprays under the Ekos line, combining Amazonian botanical fragrances with disinfectant actives certified by ANVISA. Its direct-sales and Natura Life e-commerce platforms promote refillable glass-bottle models. Natura’s commitment to rainforest conservation is reflected in carbon-neutral production of fragrance prototypes. The company’s R&D teams validate dual-function claims through in-house microbiology labs. Natura continues to explore polyphenol-based deodorizing systems sourced from guaraná and acai extracts.

The report provides a detailed analysis of the Disinfectant and Deodorant market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Disinfectant and Deodorant market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Disinfectant and Deodorant market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Disinfectant and Deodorant market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Disinfectant and Deodorant market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Disinfectant and Deodorant Market Analysis and Projection, By Companies

- Segment Overview

- Unilever

- Reckitt Benckiser

- P&G Professional

- Clorox

- Ecolab

- Orapi Hygiene

- Kimberly-Clark

- 3M

- S.C. Johnson & Son

- Sanytol

- Amity International

- Alkapharm

- Orochemie GmbH

- Steris Corporation

- Zep Inc.

- Diversey

- Sanosil

- ACTO GmbH

- Spartan Chemical

- Oxy'Pharm

- Buckeye International

- QuestSpecialty Corporation

- Kemika Group

- Global Disinfectant and Deodorant Market Analysis and Projection, By Type

- Segment Overview

- Liquid

- Aerosol

- Others

- Global Disinfectant and Deodorant Market Analysis and Projection, By Application

- Segment Overview

- Medical

- Commercial

- Household

- Industrial

- Other

- Global Disinfectant and Deodorant Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Disinfectant and Deodorant Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Disinfectant and Deodorant Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Unilever

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Reckitt Benckiser

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- P&G Professional

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Clorox

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ecolab

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Orapi Hygiene

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kimberly-Clark

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- 3M

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- S.C. Johnson & Son

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanytol

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Amity International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Alkapharm

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Orochemie GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Steris Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zep Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Diversey

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanosil

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ACTO GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Spartan Chemical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Oxy'Pharm

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Buckeye International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- QuestSpecialty Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kemika Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Disinfectant and Deodorant Market: Impact Analysis

- Restraints of Global Disinfectant and Deodorant Market: Impact Analysis

- Global Disinfectant and Deodorant Market, By Technology, 2023-2032(USD Billion)

- global Liquid, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Aerosol, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Others, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Medical, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Commercial, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Household, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Industrial, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Other, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Disinfectant and Deodorant Market Segmentation

- Disinfectant and Deodorant Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Disinfectant and Deodorant Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Disinfectant and Deodorant Market

- Disinfectant and Deodorant Market Segmentation, By Technology

- Disinfectant and Deodorant Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Disinfectant and Deodorant Market, By Technology, 2023-2032(USD Billion)

- global Liquid, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Aerosol, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Others, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Medical, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Commercial, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Household, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Industrial, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- global Other, Disinfectant and Deodorant Market, By Region, 2023-2032(USD Billion)

- Unilever: Net Sales, 2023-2033 ($ Billion)

- Unilever: Revenue Share, By Segment, 2023 (%)

- Unilever: Revenue Share, By Region, 2023 (%)

- Reckitt Benckiser: Net Sales, 2023-2033 ($ Billion)

- Reckitt Benckiser: Revenue Share, By Segment, 2023 (%)

- Reckitt Benckiser: Revenue Share, By Region, 2023 (%)

- P&G Professional: Net Sales, 2023-2033 ($ Billion)

- P&G Professional: Revenue Share, By Segment, 2023 (%)

- P&G Professional: Revenue Share, By Region, 2023 (%)

- Clorox: Net Sales, 2023-2033 ($ Billion)

- Clorox: Revenue Share, By Segment, 2023 (%)

- Clorox: Revenue Share, By Region, 2023 (%)

- Ecolab: Net Sales, 2023-2033 ($ Billion)

- Ecolab: Revenue Share, By Segment, 2023 (%)

- Ecolab: Revenue Share, By Region, 2023 (%)

- Orapi Hygiene: Net Sales, 2023-2033 ($ Billion)

- Orapi Hygiene: Revenue Share, By Segment, 2023 (%)

- Orapi Hygiene: Revenue Share, By Region, 2023 (%)

- Kimberly-Clark: Net Sales, 2023-2033 ($ Billion)

- Kimberly-Clark: Revenue Share, By Segment, 2023 (%)

- Kimberly-Clark: Revenue Share, By Region, 2023 (%)

- 3M: Net Sales, 2023-2033 ($ Billion)

- 3M: Revenue Share, By Segment, 2023 (%)

- 3M: Revenue Share, By Region, 2023 (%)

- S.C. Johnson & Son: Net Sales, 2023-2033 ($ Billion)

- S.C. Johnson & Son: Revenue Share, By Segment, 2023 (%)

- S.C. Johnson & Son: Revenue Share, By Region, 2023 (%)

- Sanytol: Net Sales, 2023-2033 ($ Billion)

- Sanytol: Revenue Share, By Segment, 2023 (%)

- Sanytol: Revenue Share, By Region, 2023 (%)

- Amity International: Net Sales, 2023-2033 ($ Billion)

- Amity International: Revenue Share, By Segment, 2023 (%)

- Amity International: Revenue Share, By Region, 2023 (%)

- Alkapharm: Net Sales, 2023-2033 ($ Billion)

- Alkapharm: Revenue Share, By Segment, 2023 (%)

- Alkapharm: Revenue Share, By Region, 2023 (%)

- Orochemie GmbH: Net Sales, 2023-2033 ($ Billion)

- Orochemie GmbH: Revenue Share, By Segment, 2023 (%)

- Orochemie GmbH: Revenue Share, By Region, 2023 (%)

- Steris Corporation: Net Sales, 2023-2033 ($ Billion)

- Steris Corporation: Revenue Share, By Segment, 2023 (%)

- Steris Corporation: Revenue Share, By Region, 2023 (%)

- Zep Inc.: Net Sales, 2023-2033 ($ Billion)

- Zep Inc.: Revenue Share, By Segment, 2023 (%)

- Zep Inc.: Revenue Share, By Region, 2023 (%)

- Diversey: Net Sales, 2023-2033 ($ Billion)

- Diversey: Revenue Share, By Segment, 2023 (%)

- Diversey: Revenue Share, By Region, 2023 (%)

- Sanosil: Net Sales, 2023-2033 ($ Billion)

- Sanosil: Revenue Share, By Segment, 2023 (%)

- Sanosil: Revenue Share, By Region, 2023 (%)

- ACTO GmbH: Net Sales, 2023-2033 ($ Billion)

- ACTO GmbH: Revenue Share, By Segment, 2023 (%)

- ACTO GmbH: Revenue Share, By Region, 2023 (%)

- Spartan Chemical: Net Sales, 2023-2033 ($ Billion)

- Spartan Chemical: Revenue Share, By Segment, 2023 (%)

- Spartan Chemical: Revenue Share, By Region, 2023 (%)

- Oxy'Pharm: Net Sales, 2023-2033 ($ Billion)

- Oxy'Pharm: Revenue Share, By Segment, 2023 (%)

- Oxy'Pharm: Revenue Share, By Region, 2023 (%)

- Buckeye International: Net Sales, 2023-2033 ($ Billion)

- Buckeye International: Revenue Share, By Segment, 2023 (%)

- Buckeye International: Revenue Share, By Region, 2023 (%)

- QuestSpecialty Corporation: Net Sales, 2023-2033 ($ Billion)

- QuestSpecialty Corporation: Revenue Share, By Segment, 2023 (%)

- QuestSpecialty Corporation: Revenue Share, By Region, 2023 (%)

- Kemika Group: Net Sales, 2023-2033 ($ Billion)

- Kemika Group: Revenue Share, By Segment, 2023 (%)

- Kemika Group: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Disinfectant and Deodorant Industry

Conducting a competitor analysis involves identifying competitors within the Disinfectant and Deodorant industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Disinfectant and Deodorant market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Disinfectant and Deodorant market research process:

Key Dimensions of Disinfectant and Deodorant Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Disinfectant and Deodorant market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Disinfectant and Deodorant industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Disinfectant and Deodorant Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Disinfectant and Deodorant Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Disinfectant and Deodorant market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Disinfectant and Deodorant market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Disinfectant and Deodorant market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Disinfectant and Deodorant industry.